Efficient Wealth Update – September 2020

‘W’here is the market going?

It goes without saying that global markets have truly had a wild time throughout 2020, breaking records of both sides of the coin. The fastest decline in stock prices on record (in the US) and the subsequent fastest rebound from their lows. But where to next?

Towards the beginning of the crisis, there were hopeful rumours of a ‘V’ shaped recovery and, for a few months, this looked to be so. However, now 6 months on, such hopes appear to have been a fantasy as unhealthy layer after unhealthy layer of the economy is being peeled back, and investors are beginning to waver. Now that the superficial period of the primary state backed funding is coming to a close, businesses are being left with the daunting realisation they soon will need to stand (or not) on their own two feet.

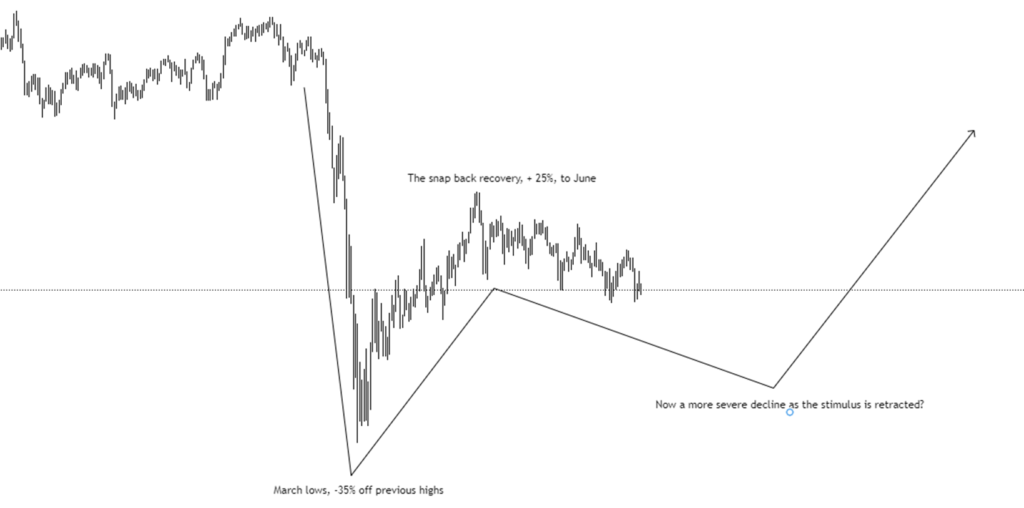

Below is a graphic of the UK’s FTSE100 index, the tracker of the countries’ biggest companies, to illustrate what potentially could be the road ahead.

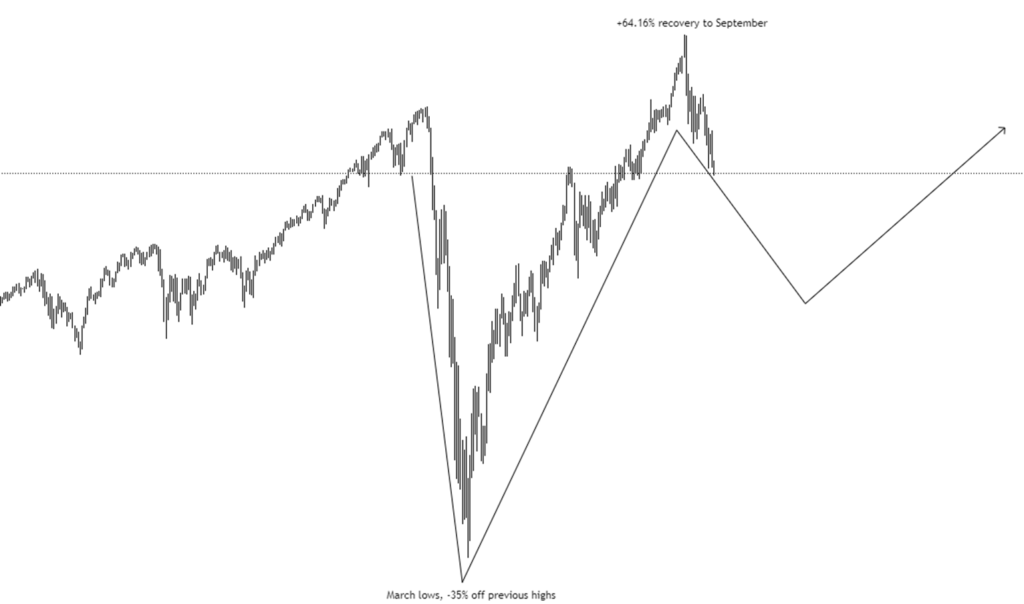

The US looks to be a similar picture. The below shows the S&P500, the US’ largest companies’ stock prices.

Given COVID-19 has reared its ugly head once more, and we are just entering another round of COVID combatant procedures, one could take the reasonable view the economy will be subdued for some time.

That said, I think we have seen just about as many theories as there are letters in the alphabet and, as the saying goes, economists have predicted 16 of the last 2 recessions, so one must always remember no one has a crystal ball and people view the market in different ways.

So, what can we do about it, irrespective of what the future holds? The answer is diversification. As we can see from the charts above, there can, have been, and will be significant swings in the value of any one market, particularly over the coming years as the world gets to grip with what arguably could be a new version of society. As a result therefore, one must not overexpose themselves to any one particular market, but spread the load as it were, to benefit from the ebbs and flows of each, ultimately providing a smoother outcome and better protection from those sharper downturns in one area. It should also never be forgotten that in the world of investing the focus should be on the long term, rather than the short term; the secret to long term growth is withstanding short term losses.

Should you have investments that you are worried about, feel free to get in touch with us to have a discussion with one of our Chartered Financial Planners. In the words of Warren Buffet, ‘diversification really is the only free lunch’.

Tax free cash-less?

For as many years as I can remember, pension legislation has been strapped to the dart board before any upcoming Budget speech, with its tax reliefs and efficiencies up for grabs by the Chancellor of the Exchequer.

To very briefly summarise, investors benefit from proportionate tax relief by paying into pensions, tax free growth within them, and 25% of the pot available free from tax upon retirement which has been commonly referred to as the ‘tax free cash’ portion of the pot. Pension assets are also free of inheritance tax upon death too, making them a very formidable way in which to hold your money.

Each year, the Chancellor delivers their primary Budget in October, where the government’s fiscal plans are laid out to keep the economy and financial system balanced. However, to add another twist to 2020, Mr. Sunak has recently announced such a Budget shall not be delivered this year owing to the extraordinary position the UK economy has been placed in by COVID-19.

To take you on a short journey through pension history, on the 6th April 2006 there was a major overhaul of pension legislation, so much so that it was even stamped with its very own name, ‘A Day’. We have seen the pension freedoms changes brought about in 2015 however nothing similarly significant since then. As a result, it has been expected some form of change was around the corner.

Given the UK’s level of borrowing has been pumped to the highest it ever has been this year to help keep the country on its feet, it could be reasonably considered that a more widespread change to taxation is more than likely, at which point, the pension landscape may well be moulded once more; at such a time, perhaps Mr. Sunak will be stripped of his title ‘Dishi Rishi’…

Nevertheless, for now, pensions will continue in their current format as being one of the most tax efficient ways to invest one’s money for their future. By making maximum use of tax breaks offered by pensions you can get to financial freedom much more quickly, so maximise them while you can!

Stuff it under the mattress?

As many savers have known for a long time now, finding a deposit account that pays a decent rate of interest is nigh on impossible. Since March, the Bank of England base rate has fallen from 0.75% to an all-time low of 0.1%, and murmurings in the press suggest that the Old Lady of Threadneedle Street, might consider cutting them further. The next move down would be to create a negative interest rate, where you pay the bank interest for them to hold on to your money. The thinking behind this is that rather than saving your money, you go out and invest (or spend) it, thus giving a boost to the economy.

One immediate effect of this is the lowering of savings rates with the high street banks. At the start of the year the Marcus Account was offering 1.85% with their easy access account. As the rates came down, savers flocked to the account and the opening of new accounts has now been suspended because they were unable to keep up with demand.

Another platform that has seen dramatic influxes has been National Savings & Investments. Most of their accounts have now been reduced to paying just 0.1% interest. Premium Bonds, the lottery style savings account, which allow you to save up to £50,000 with the potential of winning £1 million tax free. However, the average return for Premium Bonds is being cut in November from 1.4% to 1%, and as it’s a lottery, many will see returns even poorer than this.

Sadly, for savers the outlook is bleak, and there’s no suggestion that keeping your money in cash-based deposits is going to be profitable any time soon. The only long-term strategy for beating inflation is to invest in the markets through a well-managed diversified portfolio.

Minimum Pension Age Rises

The regulatory and financial landscape is ever changing and so one has to keep on top of their financial plan to ensure that it evolves with them.

Whilst it has been largely acknowledged previously, although the government had failed to confirm it until recently, the minimum age at which you will be able to start to drawing benefits from your personal pension is set to rise. For those turning 55 after 2028, the soonest you will be able to draw money down in any way from your pension will be when you turn 57, which is two years later than you can currently draw benefits.

Of course this has some benefits; it forces people to contribute for longer towards their pension and provides the pension a little extra time to grow, which will hopefully bolster your pot so you can enjoy a long and prosperous old age. While we all tend to live for longer, this would seem to be a sensible strategy.

However, for some this will be frustrating as they will have plans already made for retiring as soon as possible and have a financial plan in place to allow them to do just that. For them, the financial plan will now need to be revisited to make sure they can still achieve their goals and aspirations. For example, it might mean for some that their pension contributions are reduced, so that they can maximise their ISA contributions. ISA funds can be drawn on at any stage, and so by building that pot up now, may mean that retirement at 55 might still be possible.

Independent Mortgage Advice

Purchasing a new home, remortaging, or buying a commercial property, can incur many unforeseen costs. For this reason, many people opt to cut out the middleman, in a bid to save some money. But, in most cases, this approach is not as cost or time efficient as you may think we disagree with this approach. So, why should you consider using a mortgage expert over securing your mortgage yourself?

The truth is that using an expert can be invaluable. Mortgages can be far more complicated than you may first think and there are many layers to mortgage planning, which can be overlooked if you go it alone.

Efficient Portfolio are holistic, truly independent, Financial Planners, which means that we look at all areas of your finances to create a complimentary strategy across the board. It is our belief that mortgage advice, whilst being dealt with by a specialist, should closely tie in with your financial planning. This is how we differ from traditional Mortgage Brokers.

Like all aspects of financial planning, it is important to look at the bigger picture, and ensure that all of your ‘cogs’ are working together to help you achieve your goals, which is exactly what our independent experts will provide. Typically, a Mortgage Broker will just advise you about your mortgage; in contrast, our mortgage solution integrates all elements of your plan. For example, we’ve seen people come to us having arranged a 30-year mortgage to keep the costs low, but not realising that they will need to restructure their protection for longer, which significantly increases their costs. We can factor this into their planning, to ensure they are receiving the best solution for their specific needs. They will also look at any related life insurance, payment protection and even buildings and contents insurance you have to make sure that you have the most suitable protection in place. Having a safety net should be the cornerstone of your financial planning, so why risk your most valuable asset?

Over the last few years, the rules governing mortgages have also significantly tightened. The Mortgage Market Review, in particular, has been designed to ensure that affordability is scrutinised, background checks are far more in-depth and rate increases are reviewed. Understanding these changes, and how they work in practice, means that a mortgage adviser can ensure that you are getting the best possible deal for your circumstances, in the quickest and most-cost effective way.

Very much like using us as your Financial Planner, employing the services of a registered mortgage specialist means that you will be protected, as they have a duty of care to you. If the recommendations are not suitable for your needs, you will be covered by the FSCS, so you can complain and be compensated. By arranging the mortgage, yourself, this legal recourse is reduced.

An independent mortgage adviser will look for the best mortgage for you from the whole of the market. They aren’t on the lender’s side, they’re on yours, and are able to offer a far wider range of opportunities and choice than if you went direct. A good mortgage adviser will also review what mortgage you have in place, ensuring that your mortgage needs evolve with you over time. They will also ensure that you don’t get stung by the banks’ traditionally high fees, which are especially painful for first-time buyers.

Leaving a Legacy and Dream Retirement Webinars

Join me for 2 exclusive webinars on 8th October - at 10am I will be talking about how you can build a secure and long-lasting future for you and your loved ones in the Leaving a Legacy presentation and at 4pm I will be hosting a Dream Retirement webinar to help you build a secure and fulfilling future.

If you, or someone you know, would like to join either of these free live webinars, let us know which one you'd like to attend by contacting [email protected]

The TRIBEathlon Podcast

I am really excited to be able to introduce you to my new Podcast, TRIBEathlon. In line with an App that we will be soon launching, the TRIBEathlon podcasts aim to get to the heart of how people achieve incredible things in the running, cycling, swimming and triathlon worlds.

During lockdown I have done some amazing interviews with professional athletes, world leading coaches and world record holders, and we are now in a position to start rolling them out. In the first edition, entitled ‘Marathon Improvements’, I interviewed world famous running coach and Olympian, Jeff Galloway, to understand how we can run faster, best utilise the run/walk/run technique (affectionately known as ‘Jeffing’, as this is the man that invented it) and the mental strategies behind getting through the dark moments. Still running a marathon every month in his 70’s, what Jeff doesn’t know about running isn’t worth knowing.

If you like it, please review and share it. There will be many more to come. It should be live in Apple podcasts and the other usual places soon, but for now, this is the best link. All feedback is appreciated.

Charlie’s Mini Blog

At Efficient Portfolio we strongly believe in the power of the team-based approach, so each year we organise an annual team building day.

In previous years this has been everything from learning to make pasta, wakeboarding, hostage rescues and even eating insects as part of the Bear Grylls adventure. Clearly none of these were possible with the current restrictions but not wanting to let that stop us, earlier this month we had our team building day anyway, albeit socially distanced.

In the afternoon we were competing over zoom in Who Dares Wins and having a few drinks.

The morning was taken up with a motivational talk by former professional footballer turned endurance athlete & coach, Luke Tyburski.

One thing that Luke talked about was the power of being grateful- something I talk about in Entrepreneurial Happiness too - but it occurred to me at the time that we are so lucky that we have such a great team at Efficient Portfolio given the current challenges.

Only yesterday I was chatting to someone in the financial services sector that tried to set up their own business just over a year ago, and the COVID headwind has stopped her dead in her tracks.

It has taken 14 years to craft a team of some amazing financial planners, technically minded paraplanners, empathetic client relationship managers and a dedicated team that support them, and so we have been largely unaffected by the COVID fallout. The team has pulled together in adversity, worked effectively and collaboratively from home and perhaps most importantly, supported the clients that depend on us for their financial future.

I am incredibly grateful for the team we have at Efficient Portfolio, and for the processes we have in place that have allowed us to thrive despite the challenges. What are you grateful for that COVID has brought more clearly into focus?

Book Recommendation

In my opinion, one of the best marketing books ever written was Simon Sinek’s ‘Start with Why’ and whilst Sinek’s subsequent books have been good enough to recommend, none have ever come close to this. However, in his latest book ‘The Infinite Game: How Great Businesses Achieve Long-Lasting Success’ he has come close to matching his original masterpiece.

In essence, the concept is simple; the best businesses are built on the foundation that they will continue to evolve forever. There are less short-term specific goals, but more evergreen long term goals that will continue to be relevant 10 years down the line. For example, at Efficient Portfolio our mission is to ‘create a better future through inspirational financial planning’ and regardless of how the landscape changes, this will remain a common aim. If you are a leader in business, this will prove a thought provoking read for sure.